When job seekers are on the hunt for a new job, you might think that a higher salary is the most attractive aspect. But studies have shown that it’s not always the case. Nowadays, employees desire more than just money to feel valued and motivated. That’s why having a solid benefits package is crucial if you want to attract and keep top talent. So, whether you’re starting a new business or improving an existing one, make sure to include employee benefits in the compensation package for new hires.

It’s not just about legal obligations; employee benefits play a key role in the long-term success of a company. In this article, we’ll go over some common examples of small business employees. It will help you to encourage great employees to stick around and ensure the long-term success of your business.

Also Read: 10 Proven Tax Saving Strategies for Self-Employed

Employee Benefits: Definition and Importance

These are benefits or extra perks that go beyond just their hourly, monthly or annual salary. For example, medical cover, retirement benefits, paid leaves etc. These benefits are important because they help attract and keep good employees.

The specific benefits you offer will depend on factors like the industry you’re in, the size of your business, and what your employees value. A well-designed employee benefits package can be a great way to recruit and retain top-notch talent. It’s like telling your employees, “Hey, we value you and want to take care of you!”

Essential Benefits for Employees in Small Businesses

Small businesses must provide certain employee benefits to comply with laws and regulations set by the U.S. Department of Labor. If you do to comply, you may face significant fines and other consequences. Some of the popular benefits are given below:

1. Workers’ Compensation: Protecting Employers and Employees

It is an insurance that safeguards both employers and employees in case of work-related accidents or illnesses. It is mandatory in all states except Texas. It covers medical treatment, lost wages, rehabilitation care, and disability costs for employees.

To determine your state’s workers’ compensation requirements, you need to research the specific laws applicable to your location. Keep in mind that the rates you pay will depend on the nature of your employees’ work.

For ex., industries like accounting that involve office work generally have lower rates compared to higher-risk industries like construction.

2. Unemployment Insurance: Assisting Workers in Job Loss

It provides financial compensation to workers who lose their jobs without any misconduct or errors. If an employee leaves your business and files for this compensation, you will receive a notification and the corresponding funds will be deducted from your unemployment account.

The amount you pay will be based on your state’s guidelines, which calculate a tax percentage on a base wage.

3. Disability Insurance: Protection for Nonwork-Related Injuries or Illnesses

For those small business operates in states like California, Hawaii, New Jersey, etc. are required to provide disability insurance. This insurance covers employees who are unable to work due to serious nonwork-related injuries or illnesses..

Short-term disability typically provides income replacement for a period of 2 to 6 months, offering up to 70% of the employee’s current income. On the other hand, long-term disability pays 50% to 70% of their monthly income. Also, it can last for several years or even decades, depending on the specific plan in place.

4. COBRA: Continuation of Health Insurance

COBRA is a federal law that requires you to offer health insurance coverage to former employees and their families for either 18 or 36 months. However, the terminated employee will need to pay the entire premium, including their portion and the portion you used to cover for them.

5. Social Security and Medicare: Federal Programs

It is an insurance cover that employees in the U.S. must contribute through employer deductions. Social Security benefits provide retirement or permanent disability income. While other one is for individuals who are 65 or diagnosed with specific medical conditions or disabilities.

According to the FICA, both employer and employee must contribute 6.2% of the worker’s wages to Social Security and 1.45% to Medicare.

6. Family and Medical Leave: Employee Protection

The FMLA safeguards employees during important life events like childbirth or adoption. While it doesn’t cost you anything directly, it does require you to offer up to 12 weeks of unpaid leave and maintain health benefits.

7. Health Insurance: Affordable Care Act Requirement

Under the Affordable Care Act, businesses with 50 or more employees are required to provide health insurance. You’ve got a bunch of options to choose from, like fully insured plans, partially self-funded plans, PPO plans, and HMO plans. It’s all about finding the plan that fits your unique situation best. So take a look at your needs and preferences, and pick the one that works for you!

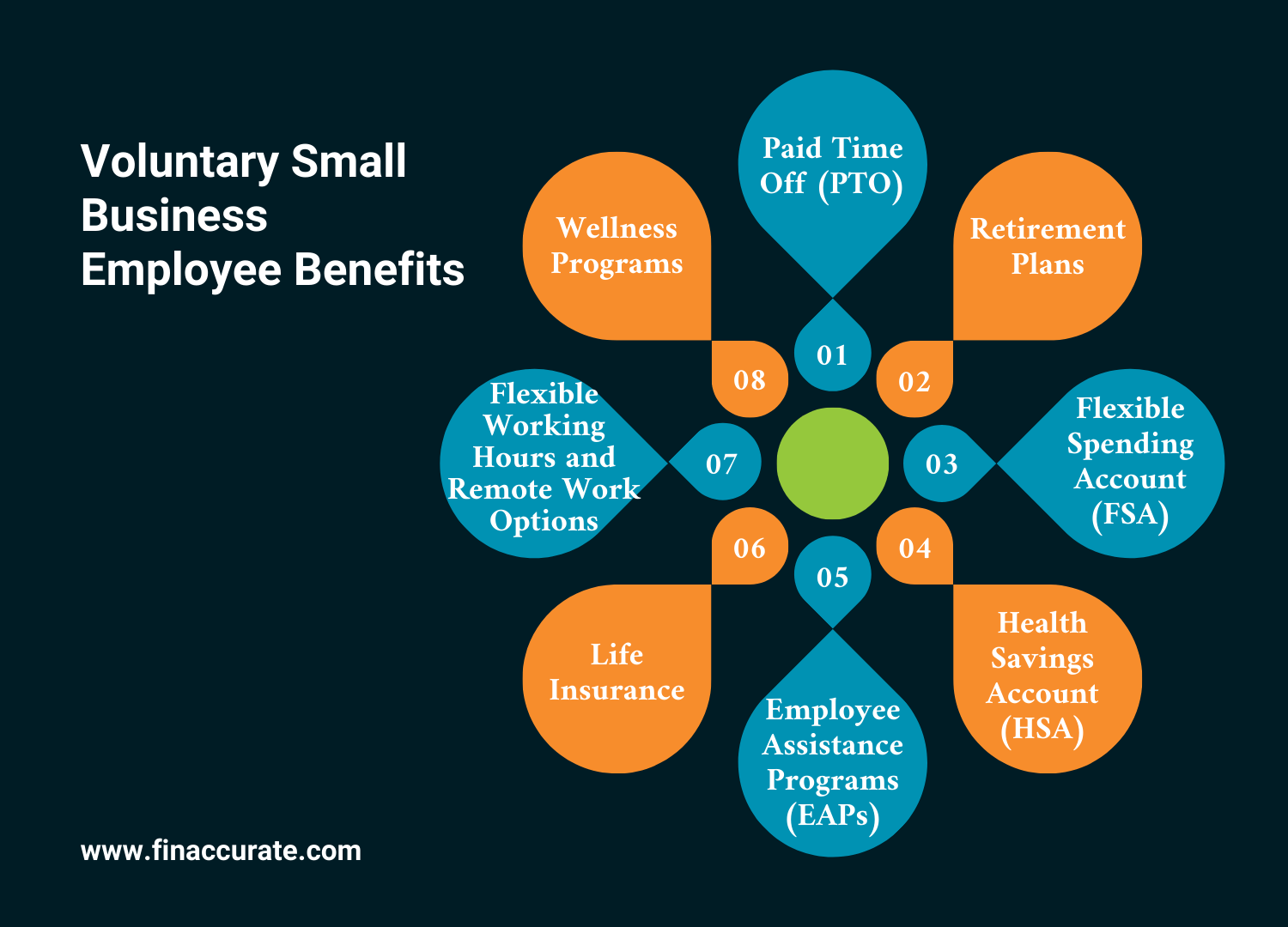

Voluntary Benefits for Small Business Employees

Small businesses nowadays are going the extra mile to recruit and retain top-notch employees. One such way is through voluntary benefits, or as some call them, “fringe” benefits.

These perks may come at a cost, but they can make all the difference between having loyal, long-term team members or experiencing high turnover rates.

Also Read: Top 5 Reasons Why a Small Business Should Do Bank Reconciliation

1. Paid Time Off (PTO):

Everyone needs a break now and then, right? Well, small businesses are recognizing the importance of work-life balance by offering paid time off. This means that when employees go on vacation, take a sick day, or even have a doctor’s appointment or childcare duties, they still get paid.

Some businesses are even taking it up a notch with unlimited PTO. It gives employees the freedom to take as much time off as they need, as long as their manager gives the thumbs up.

2. Retirement Plans:

Let’s face it, everyone wants to feel financially secure when they retire. Small businesses get it, which is why they offer retirement plans as a fantastic perk. There are different options available, such as simplified employee pension plans (SEP-IRAs), SIMPLE IRAs, and 401(k) plans. Employees have the choice to participate by contributing a portion of their paycheck. Plus, some businesses sweeten the deal by matching those contributions.

3. Flexible Spending Account (FSA):

These nifty accounts allow employees to set aside a portion of their earnings before taxes to cover eligible medical expenses. Think deductibles, copayments, prescription drugs, and medical devices. Just remember, FSAs typically come with a “use it or lose it” rule, meaning employees need to spend the funds within the plan year to avoid losing them.

4. Health Savings Account (HSA):

High-deductible health plans are becoming more common, and that’s where HSAs come into play. Employees enrolled in these plans can stash away their own money before taxes to pay for medical expenses.

The best part is, funds left unspent roll over to the next year, and if they switch jobs, they can take their HSA with them. Contributions, growth, and withdrawals from the HSA are all tax-free?

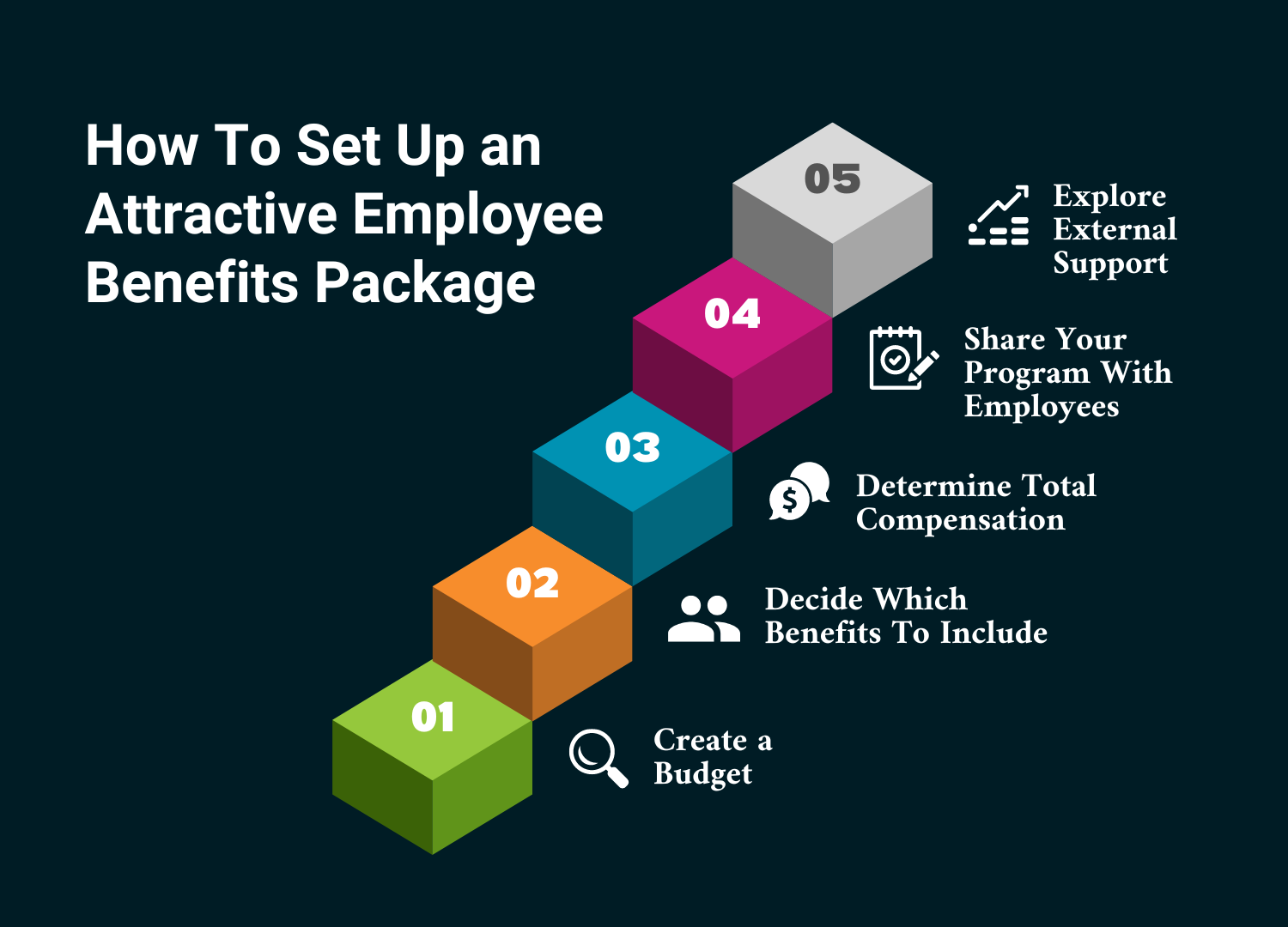

How to craft an attractive Employee Benefits Package?

1. Set a budget:

Determine how much your company can spend on employee benefits.

2. Choose the benefits:

Decide which benefits to include, such as workers’ compensation, Medicare, Social Security, as well as optional perks like flexible schedules and remote work opportunities.

3. Calculate total compensation:

Consider all elements of your benefits package, including health insurance, bonuses, gym discounts, and employee assistance programs (EAPs), and communicate this as part of the total compensation.

4. Seek external support:

Consider hiring a benefits consultant or a professional employer organization (PEO) to help manage payroll and HR tasks, saving you time and reducing uncertainty.

5. Communicate with employees:

Share the finalized benefits program with your employees through meetings, where you can explain the benefits and answer any questions. Update your job postings and website career page to inform prospective employees about the benefits they can expect.

Also Read: 7 Essential Qualities Of A Good Bookkeeper For A Small Business

Conclusion

Creating an employee benefits package may seem like a hassle, but trust me, it can work wonders for your small business. When you put together a thoughtful package that caters to your unique employees, it’s like magic. It can prevent burnout, boost morale, and make people stick around longer, which is great for your bottom line.

Think about it. When you offer benefits that genuinely support your employees’ well-being, they feel valued and appreciated. And let me tell you, that goes a long way. When your team feels taken care of, they’re less likely to experience burnout. They’ll have a renewed sense of energy and motivation, ready to tackle any challenge that comes their way.

And here’s the kicker: a solid benefits package can actually improve your retention rates. It’s like building a loyal tribe of superstars who are committed to your business’s success.

But wait, there’s more! Offering attractive benefits can also give you a competitive edge in the job market.

Investing in a well-designed benefits package is not just an expense, my friend. It’s an investment that pays off. Happy and engaged employees are more productive, which means more profits for your business. Plus, when you have low turnover, you save money on recruitment and training costs. It’s a win-win situation all around.

So, don’t underestimate the power of a carefully crafted employee benefits package. It’s a smart move that can transform your business and create a positive work environment where everyone thrives.

Jay’s Choice:-

1. The Benefits of Cloud-Based Accounting for Small Businesses

2. Cryptocurrency and Taxes: What You Need to Know

3. How Artificial Intelligence is Revolutionizing Accounting Industry

4. The Future of Financial Management: Trends to Watch in 2023

5. Sustainability Accounting: The Key to Building a Greener Business

6. Corporate Social Responsibility Accounting: A New Era of Transparency[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]