Our blog simplifies the Square 1099 tax form. Understanding and completing tax paperwork can be stressful during tax season. We’ll simplify the Square 1099 tax form procedure in our detailed tutorial. This blog will ease tax filing for small business owners and freelancers using Square. Let’s tackle the Square 1099 tax form’s difficulties.

Square 1099 for 2021

In March 2021, Congress changed the rules about trades that have to be reported by lowering the minimum amount that has to be reported. But the IRS has put off lowering the threshold for sales on Form 1099-K until 2022. Visit the IRS web website online to discover more.

This guide talks about Square Tax Reporting and Form 1099-K. It talks about how to qualify, what the IRS rules are, and how to change the Federal Business Tax ID (EIN) that is linked to your Square account.

If you don’t have an EIN, you can use Square’s free EIN helper to apply for one. The assistant walks you through the software program process. The IRS can also help you get an EIN.

Payment Settlement Entities, like Square, have to tell the IRS how many payments their U.S. account users got. A Form 1099-K is the information return that is sent to both the IRS and customers who qualified. Check out this example of Form 1099-K.

How to Get The 1099 Form From Square?

If you are eligible, you can download your Form(s) 1099-K from the Tax Forms tab of your Square Dashboard.

What Amount Does Square Report to IRS?

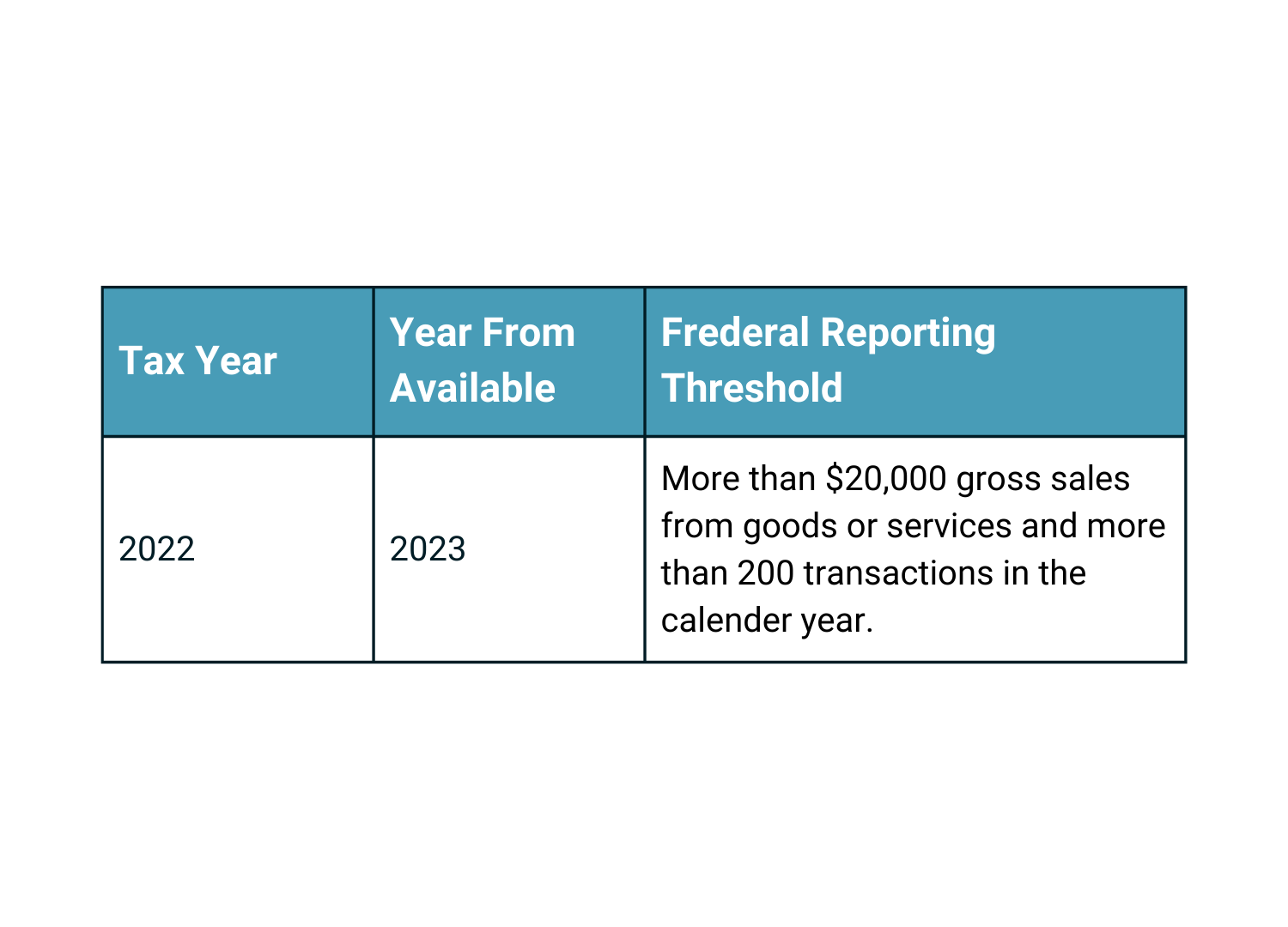

In the United States, whether or not you can get a Form 1099-K depends on the state where your tax information is stored. In most states, Square has to send a Form 1099-K to the IRS for accounts that meet both of the following criteria:

- More than $20,000 in income from products or offerings all throughout the year.

- And more than 200 deals in a full year

Square may report amounts below these limits to meet state and other reporting requirements, but it is up to Square to decide whether or not to do so.

- When $600 or more is paid by card, District of Columbia Square has to fill out a Form 1099-K and send it to the state.

- When more than three transactions and more than $1,000 in card payments are handled in Illinois, Square has to fill out a Form 1099-K and send it to the state.

- When $600 or more is taken in card payments, Maryland Square must fill out a Form 1099-K and send it to the state.

- When $600 or more is taken in card payments, Massachusetts Square must fill out a Form 1099-K and send it to the state.

- When $1,200 or more is taken in card payments, Missouri Square must fill out a Form 1099-K and send it to the state.

- When $600 or more is taken in card purchases, Vermont Square must fill out a Form 1099-K and send it to the state.

- When $600 or more is taken in card payments, Virginia Square must fill out a Form 1099-K and send it to the state.

These reporting thresholds are based on the total gross sales amount processed on all accounts with the same Tax Identification Number (TIN). If you have more than one account with the same TIN, we will add up the amount of all of your accounts to see if you are eligible for a Form 1099-K. Find out how to change the Taxpayer ID number that is linked to your account.

The IRS wants Square to send this information for every account that needs a Form 1099-K, even if it is for a non-profit. The IRS says that a person’s gross income is all of the money they made in a given year.

How Many 1099 Forms Are There?

Learn about the different kinds of information returns that are used to report different kinds of payments or transactions.

The IRS’s information return program is one of the most important tools it uses to stop people from not reporting all of their income. “Information return” is not the same thing as a tax return. Instead, it is a document that tells the IRS about a cash transaction. Most information returns are used to tell the IRS about taxable income that isn’t paid or wages and/or isn’t withheld. The person or business that paid you has to fill out the form, send it to the IRS, and give you a copy.

The IRS computers compare the amounts on the information returns they get to the amount of income you report on your tax return. If you said you made less money than what was shown on the information return, you will get a letter asking you to pay extra taxes, interest, and fines.

How well does the method for getting information work? More than 2.23 billion information reports were sent to the IRS. It used the information on these returns to call more than 4.5 million taxpayers who had not given enough information. Because of these contacts, an extra $7,112,605,000 in taxes had to be paid in 2012.

Information returns come in many different forms. Each one is used to report a different kind of trade or payment. The 1099 forms are used for most information reports. Here are some:

- 1099-A, Acquisition or Disposition of Secured Property

- 1099-B, Proceeds from Broker and Barter Exchange Transactions

- 1099-C: Cancellation of Debt

- 1099-CAP: Changes in Control and Capital Structure of a Corporation

- 1099-DIV Dividends and Distributions

- 1099-G, Certain Payments Made by the Government

- 1099-H, Advance Payments for the Health Coverage Tax Credit (HCTC)

- 1099-INT is for interest income.

- 1099-K is for payments made with a merchant card or a third-party network.

- 1099-LTC is for long-term care and accelerated death benefits.

- 1099-MISC, Miscellaneous Income

- 1099-OID, Original Issue Discount

- 1099-PATR, Distributions From Cooperatives That Are Taxable

- 1099-Q, Payments from Qualified Education Programs (529 and 530)

- Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.,

- Form 1099-R.

- 1099-SA, Distributions From an HSA, an Archer MSA, or a Medicare Advantage MSA

Most people will only get a few of these different forms, which is good news. These things are:

The Form 1099-INT

If you got more than $10 in interest from a bank or credit union during the year, they have to fill out this form.

1099-DIV

This form needs to be filled out if you own shares or other securities and get more than $10 in dividends, capital gain distributions, nontaxable distributions, or liquidation distributions.

1099-MISC

Clients who pay an independent worker at least $600 for professional services during the year must fill out this form.

1099-K

This form needs to be filled out if you run a business and have at least 200 transactions and $20,000 in sales handled by third-party payment processors like PayPal and Google Checkout during the year. Payment providers for credit cards also give out this form.

1099-B

When you sell a stock, your broker or mutual fund company has to fill out this form. It shows the date and amount of the sale, as well as the cost base.

1099-G

This form is used to report unemployment benefits, refunds of state and local income taxes, payments to farmers, and gifts that are taxable.

1099-R

This is the form you need to fill out when you get money from a retirement plan like an IRS, Roth IRA, or 401(k).

Conclusion:

In conclusion, understanding and simplifying the Square 1099 tax form is essential for small business owners and freelancers. By familiarizing themselves with the key elements and requirements of this form, individuals can ensure accurate reporting of their income and avoid potential penalties or audits. It is crucial to maintain organized records, track transactions, and consult with tax professionals if needed to navigate the complexities of tax obligations effectively.

To learn more about tax forms and gain comprehensive insights into managing your finances, visit finaccurate.com. Explore their resources and expert guidance to stay informed and make informed financial decisions. Don’t let tax complexities hold you back – empower yourself with knowledge and take control of your financial future today.