Welcome to our tax advisory blog for small businesses, with a focus on optimizing your tax planning. In this post, we’ll explore strategies to effectively manage your taxes, while maintaining accurate financial records. With the right approach to tax planning and diligent bookkeeping practices, you can minimize your tax burden, maximize savings, and ensure compliance with tax regulations. Discover valuable insights and actionable tips for strategic tax planning. An efficient small business bookkeeping that contributes to your financial success. Get ready to unlock the full potential of your small business through effective tax and bookkeeping strategies.

What is Planning for Taxes for a Small Business?

Tax planning is an important part of running a small business well. It means knowing and taking care of your tax responsibilities while getting the most out of deductions and credits to lower your tax bill.

Why is Tax Planning Essential For Small Businesses?

As a business owner, you have to pay taxes, but the amount you have to pay shouldn’t come as a surprise. To make sure you have the right amount of money, you need to know how business taxes work and estimate how much you need to pay each quarter or year.

Tax planning can help you make accurate tax predictions, file, and report. All of your taxes on time, and avoid the possible consequences of not doing these things. Since taxes for a business can be hard to understand, we suggest working with an experienced tax agent to help you plan your taxes. You should also know that the best way to save money on taxes is often to plan.

Consult a tax Advisor

As the owner of a small business, one of the best things you can do to reduce the amount of tax you have to pay is to talk to a tax adviser. Even if you pay close attention to business news and keep up with changes to tax laws, you still need help from a professional to file your taxes.

Filing taxes for a business can be hard, and if you make a mistake or forget something, you may have to pay a lot. In the end, it will be cheaper to pay for a tax adviser than to try to fix a mistake you made on your taxes.

Tax Planning Strategies

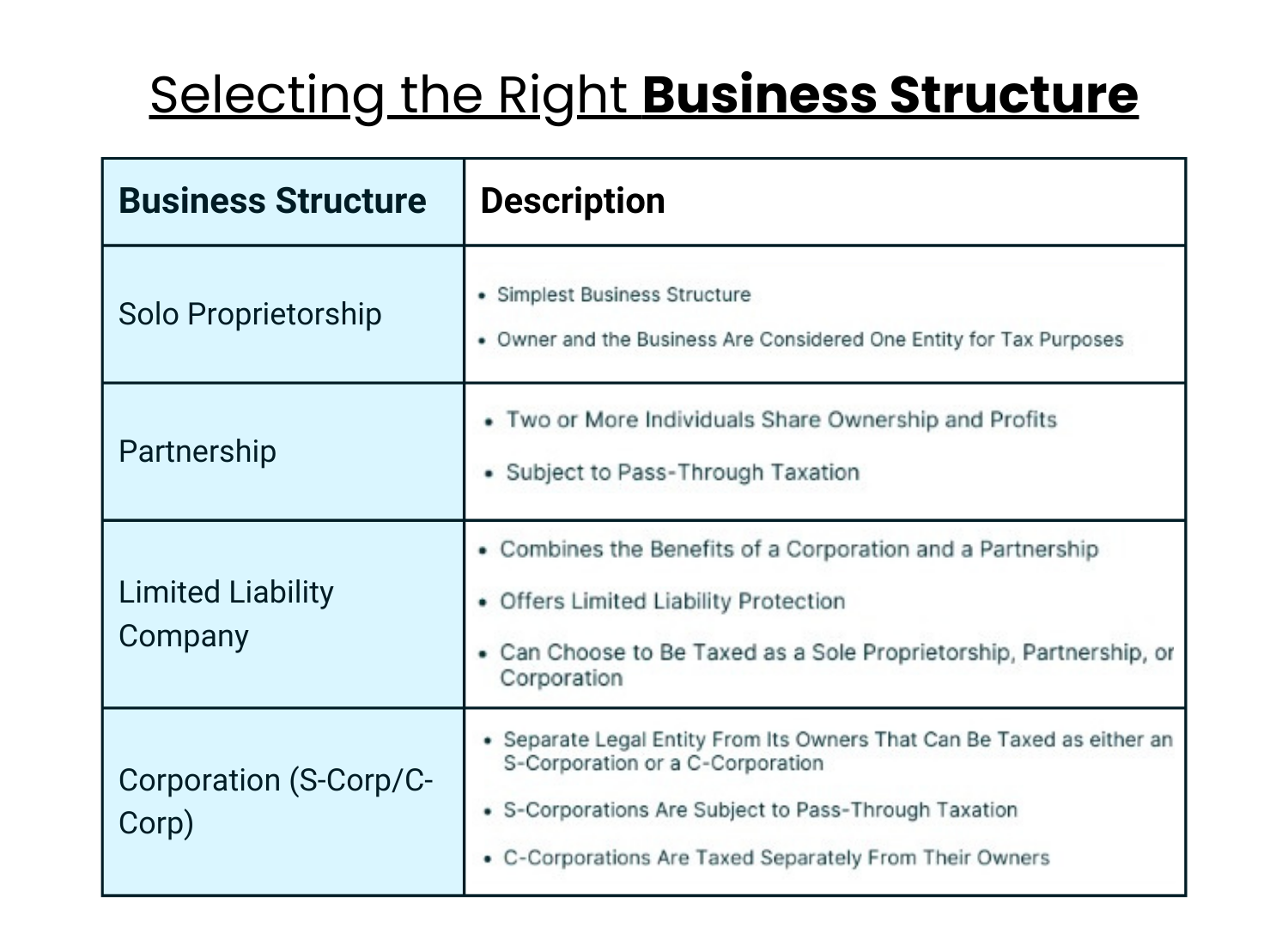

Choosing the Right Structure for Your Business

Single Ownership

The easiest way to run a business is as a sole proprietorship, where the owner and the company are taxed as a single unit.

Partnership

A partnership is a way for two or more people to run a business where they share ownership and earnings. Pass-via taxation applies to partnerships. This means that gains are given to partners and taxed at their tax rates.

LLC stands for Limited Liability Company

An LLC is a flexible business organization that combines the best parts of a corporation and a partnership. It has limited liability and can be taxed as either a single proprietorship, a partnership, or a corporation.

Corporations (S-Corp and C-Corp)

An organization is a separate criminal entity from its owners. It can be taxed as either an S-company or a C-Corporation. C-Corporations are treated separately from their owners, while S-Corporations are taxed the same way their owners are.

Maximizing Tax Deductions and Credits

Common Tax Breaks For Small Businesses

Small businesses can get tax breaks for things like business costs, using a car for work, having a home office, and depreciation.

Small agencies can follow tax credits

Tax credits, like the Research and Experimentation Tax Credit and the Work Opportunity Tax Credit, can help a small business pay less tax.

Expense Tracking and Documentation

Important to Keep Accurate Records Keeping

Accurate records of business costs are important to get the most tax deductions and reduce the risk of an audit.

Expense Tracking Tools And Software

Accounting software and cost-tracking apps can help small business owners. To keep track of their expenses and make it easier to do their taxes.

Retirement and Benefit Plans

There are tax benefits to retirement plans

Small business owners and their workers can get tax breaks if they set up retirement plans like SEP IRAs or 401(k)s.

Plan Types For Small Business Owners’ Retirement

Small business owners can choose from several retirement plans, such as SIMPLE IRAs, SEP IRAs, Solo 401(k)s, and traditional 401(k) plans. Each plan has its own rules for who can join, how much can be contributed, and tax benefits.

Plans For Employee Benefits And What They Mean For Taxes

By giving employees benefits like health insurance and help with school, a business can save money on taxes and draw and keep good workers.

Tax Planning All Through the Year

Quarterly Expected Tax Payments

Small business owners and people who work for themselves usually have to pay estimated taxes throughout the year to avoid fines.

Regularly Looking at And Planning for Finances

Small businesses can stay on track and save the most tax money. If they regularly check their finances and update their tax planning strategies.

Strategies for Getting Tax Breaks

Using tax-loss harvesting techniques, like selling assets that aren’t doing well to offset capital gains, can help you pay less tax.

Working With Tax Professionals

Why it’s a Good Idea to Hire a Tax Consultant or Accountant

Hiring a tax professional can help small business owners deal with complicated tax laws, make sure they are following the rules, and save the most money possible on taxes.

How to Choose the Right Tax Expert for Your Business

When choosing a tax professional for your business. You should think about things like experience and understanding of the industry. And how well they communicate.

Working With Tax Professionals to Plan for the Future

Keeping in touch with a tax professional can help small business owners plan for their taxes and adjust to changes in tax rules.

Keeping up With Changes to Tax Law

The Importance of Staying Informed

Tax rules are always changing, and it’s important to know about these changes if you want to plan your taxes well.

Updates on Tax Law From These Sources

Small business owners can keep up with changes to tax laws by using the IRS website, professional groups, and tax emails.

Changing Tax Planning Plans as Necessary

As tax rules change, small business owners should change how they plan for taxes to make sure they follow the law and save the most money on taxes.

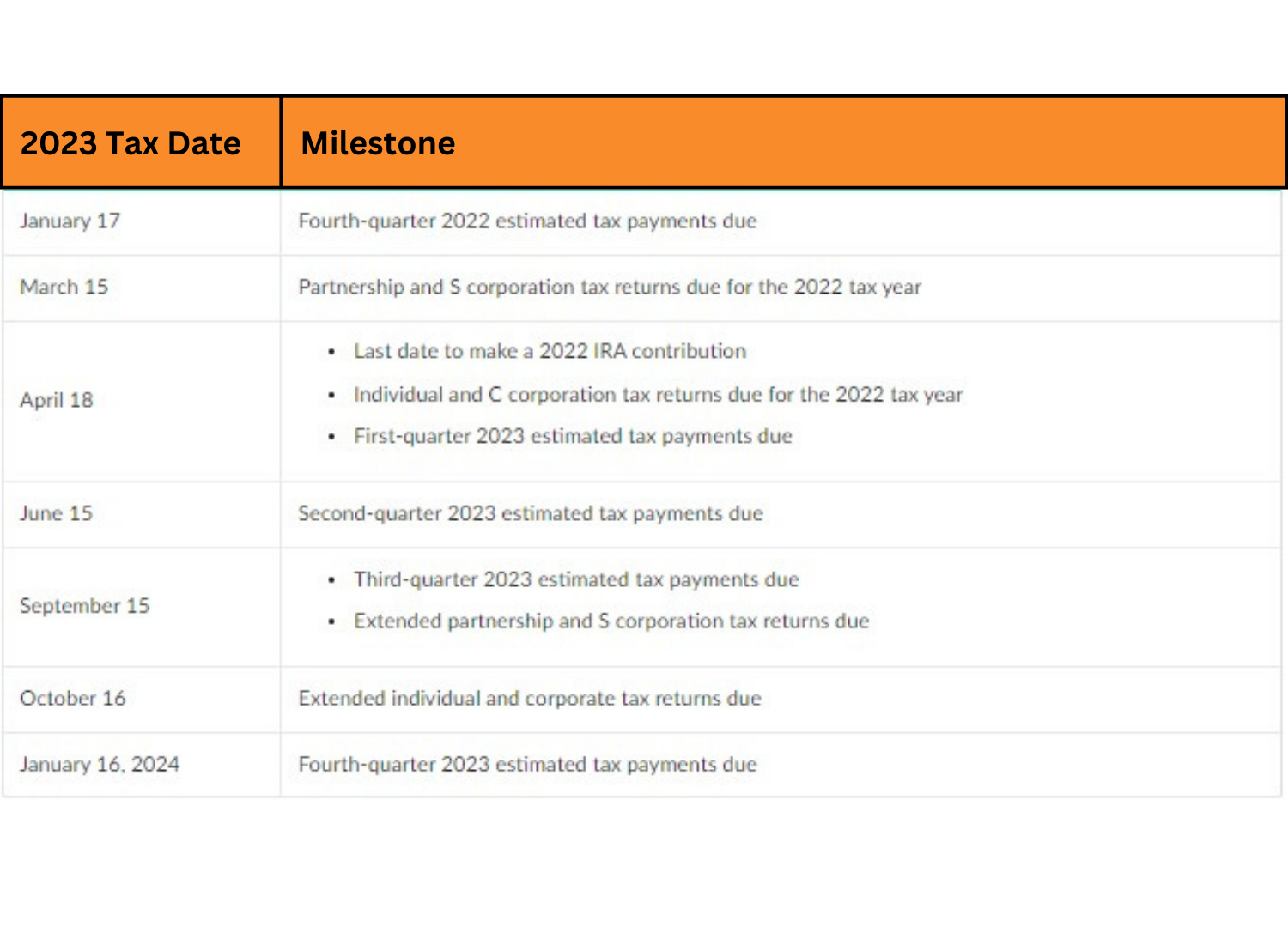

Important Dates for Filing Taxes in 2023

Most people’s tax day is April 15. If that date happens on a weekend or holiday, however, the IRS moves the deadline to the next business day. But April 15 isn’t the only date that small business owners need to remember. Here are some more important times to put on your 2023 tax filing calendar:

Before making any major adjustments, consult a tax professional. About these small business tax planning tips. Every business’s tax position is unique. These recommendations should help you prepare for your year-end tax planning meeting. And understand how your small business can save on taxes.

Conclusion:

In conclusion, optimizing your tax planning is essential for the success and growth of your small business. By implementing smart strategies and staying informed about the latest tax regulations. You can minimize your tax liabilities and maximize your business’s financial health.

However, tax planning can be complex and overwhelming, especially for small business owners who already have a lot on their plates. That’s why it’s crucial to seek professional assistance from experienced tax advisors who can guide you through the process.