Key success Indicators (KPIs) are the tools you use to measure and track progress in important parts of your business’s cash flow and success. Your KPIs give you a general idea of how healthy your business is as a whole. When you know what your KPIs are telling you, you can be proactive and make the changes that need to be made in areas that aren’t doing well, preventing what could be major losses. The KPI measurement then lets you measure how well your work is doing. This process makes sure that your company’s business plan will last for a long time and helps increase the value of your business as an investment.

The first step is to figure out and understand how your business is affected by the different financial facts that your KPI numbers show. Then, use the valuable information you get from these financial management performance indicators to find problems with policies, processes, people, or goods that are affecting one or more of your KPI values and make changes to fix them.

Managing your business’s finances is crucial for success. A vital aspect of financial management is tracking your cash flow—the money flowing in and out of your company.

You probably already use sales, expenses, gross profit, and net profit as your main KPIs. Other crucial indicators that should be tracked, analyzed, and acted on as needed are listed below. In this blog post, we’ll explore 10 key indicators to monitor closely. By understanding these indicators, you’ll gain insights into your business’s financial health and make informed decisions to drive growth. Learn practical tips for effective cash flow management and seize opportunities for long-term success. Let’s dive in!

1. Operating Cash Flow

Keeping an eye on and studying your Operating Cash Flow is a must if you want to know if you can pay for deliveries and other regular business costs. This KPI is also compared to the total amount of capital you are using. This is a study that shows if your operations are making enough cash to support the capital investments you are making to grow your business.

By comparing your working small business cash flow to your total capital used, you can get a better idea of how healthy your business is financially. This lets you make decisions about capital investments based on more than just profits.

2. Working Capital

“Working capital” is money that can be used right away. To figure out your Working Capital, take your business’s current expenses and subtract them from its current assets. This KPI equation takes into account cash on hand, accounts receivable, and short-term investments. It also takes into account accounts payable, costs that have already been paid, and loans.

This KPI is especially helpful because it tells you how your business is doing in terms of its running funds. It does this by showing you how much your short-term financial liabilities can be covered by your short-term assets.

3. The Current Ratio

With the Working Capital KPI, liabilities are subtracted from assets. With the Current Ratio KPI, total assets are divided by total liabilities. This tells you how well your business is set up to meet its financial obligations on time and maintain a level of credit rating that is needed to grow and expand your business.

4. The Ratio of Debt to Equity

The debt-to-equity ratio is found by comparing the total debts of your business to the total net worth of its owners. This KPI shows how well your small business cash flow is growing and how well you are using the money your partners have given you. The number shows how well the business is doing. It tells you and the other people who own shares in the business how much debt the business has taken on to try to make money. A high debt-to-equity ratio shows that growth is being paid for by taking on more debt. This important KPI helps you keep your financial responsibility in mind.

5. LOB Revenue Vs. Target

This KPI compares how much money you made from a business line to how much money you thought you would make from it. By keeping track of and analyzing the differences between real revenues and your projections, you can figure out how well a certain department is doing financially. This is one of the two most important parts of figuring out the Budget Variance KPI, which compares the planned and real operating budget totals. You need to do this so that you can budget more accurately for your needs.

6. LOB Expenses Vs. Budget

This KPI is made by comparing the real expenses to the budgeted amount. The comparison helps you figure out where and why some of your planned spending didn’t go as planned, so you can budget better in the future. The other main part of the Budget Variance KPI is the difference between expenses and the budget. Knowing the difference between the total assumed ratio of revenues to costs and the total real ratio helps you become an expert on how your business works and how its finances work.

7. Turnover of Accounts Payable

Payable Accounts Turnover KPI tells you how quickly your business pays its bills. The ratio is the result of dividing the total costs of sales during a period (the costs your business incurred while selling its goods or services) by the average accounts payable for that period.

When compared across different time periods, this number tells us a lot. A decreasing accounts payable turnover KPI could mean that your company is taking longer to pay its suppliers and that action is needed to keep your good standing with your vendors and allow your business to take advantage of significant discounts that vendors offer based on how quickly you pay them.

8. The Turnover of Accounts Receivable

The accounts receivable movement KPI shows how fast your business is able to get payments from customers who owe you money. This KPI is found by splitting your total sales for a given time period by the average amount of money you owe to customers for that time period. This number can be used as a sign that changes need to be made to the way debts are managed so that payments are collected on time.

9. Turnover of Inventory

Stock moves in and out of your production and storage facilities all the time. It can be hard to picture how much change is actually happening. The inventory turnover key performance indicator (KPI) tells you how much of your company’s average merchandise it has sold in a given time period. This KPI is found by dividing sales over a given time period by the average number of items in stock over the same time period. The KPI shows you how well your business sells and how well it makes things.

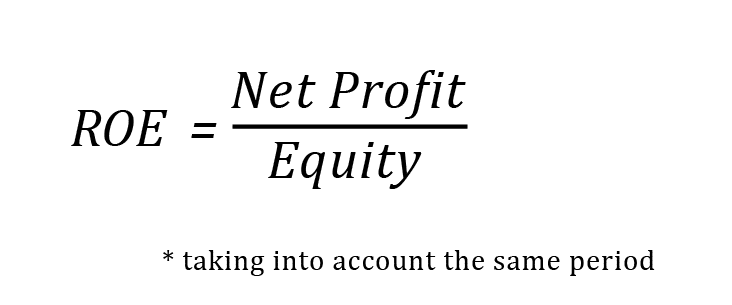

10. Return on Equity (ROE)

The Return on Equity (ROE) KPI compares the net income of your small business cash flow to the net worth of each partner. Your ROE shows whether or not your company’s net income is right for its size by comparing it to the company’s total wealth.

No matter how much your business is worth right now (its net worth), its likely worth in the future will depend on how much it makes now. So, your business’s ROE percentage tells you both how profitable it is and how well it manages its finances and operations as a whole. A growing or high ROE shows your owners that their investments are being used in the best way possible to grow the business.

Extra Key Indicators

Some other KPIs should be watched in specific operational areas like finance, marketing, production, purchasing, customer service, and others. For examples:

Marketing Key Performance Indicators (KPIs)

Cost Ratio of Customer Acquisition to Lifetime Value, Customer Acquisition Cost, Lifetime Value, and others, Customer Profitability Score, and Relative Market Share.

Recurring Revenue Metrics

these are areas of income and costs, such as recurring service contract fees, membership fees, product maintenance fees, Revenue Growth Rate, and Cash Conversion Cycle.

Recurring Revenue Overview

Include Recurring Revenue Proportion, Recurring Revenue Growth Rate, and Recurring Revenue Exit Rate.

LOB Efficiency Measure

Operating Cycle Time (rate of output), Capacity Utilization Rate, Process Downtime Level, Human Capital Value Added, Employee Engagement Level, and Quality Index are all ways to measure the efficiency of a line of business.

Finance Department

Operational Key Performance Indicators (KPIs) should also include things like the Finance Error Report KPI and the Payment Error Rate KPI. And a number of indicators in areas like billing and transaction control, collections, and others.

KPI Errors can be caused by any of the following:

- Most of the time, planning problems or mistakes made by people are the easiest to spot.

- Customizing a KPI without first making sure it is useful to the business in real life can lead to bad results. This kind of KPI can take you and your team’s attention away from real success indicators and send your business in the wrong direction.

- Overemphasizing the KPI number itself and underemphasizing the real-world practical factors that make the number possible is one way to use KPIs in a bad way.

This problem can make it hard to figure out how to improve the parts of a business that are behind the numbers.

Conclusion:

In conclusion, tracking your small business cash flow is essential for maintaining a healthy financial foundation. By monitoring the 10 key indicators discussed in this blog post, you can gain valuable insights into your company’s financial health and make informed decisions to drive growth and sustainability. Remember to regularly analyze your cash flow, understand the signs of positive and negative cash flow, and take proactive measures to address any potential issues. With effective small business cash flow management, you can navigate financial challenges, seize opportunities, and position your business for long-term success. Stay vigilant, stay informed, and let your business’s cash flow be the guiding force behind your financial decisions.

Jay’s Choice:-

1. The Benefits of Cloud-Based Accounting for Small Businesses

2. Cryptocurrency and Taxes: What You Need to Know

3. How Artificial Intelligence is Revolutionizing Accounting Industry

4. The Future of Financial Management: Trends to Watch in 2023

5. Sustainability Accounting: The Key to Building a Greener Business

6. Corporate Social Responsibility Accounting: A New Era of Transparency