Accurate bookkeeping services are essential for small business’ success as they help keep track of financial data and ensure accurate reporting.

This blog will explore why bookkeeping services are so critical for small business success.

Definition of Accurate Bookkeeping

Accurate bookkeeping is the process of ensuring that all stated financial values in an accounting system properly reflect all underlying facts and are free from any bias or manipulation.

This includes providing accurate information in the financial statements and making sure that all necessary details are disclosed. It is essential for creating reliable and trustworthy financial statements.

Overview of the importance of accurate bookkeeping for small businesses

Accurate bookkeeping is a process of recording and tracking a company’s financial transactions in an organized manner.

It is a necessary tool for business owners and managers to help them measure and manage the profitability of their businesses.

Bookkeeping data is also used to generate reports and make informed decisions about investments.

Benefits of Accurate Bookkeeping

Bookkeeping is an essential part of any business’s financial planning, no matter its size. Unfortunately, many small business owners overlook this task while they attempt to juggle other responsibilities.

Without proper bookkeeping, however, a business can quickly find itself in financial trouble.

Poor financial management is the leading cause of small business failure.

According to Investopedia, the four most common causes of business closures are lack of capital, mismanagement, insufficient planning, and cash flow issues.

Bookkeeping and accounting are key to understanding and improving the financial health of a business.

Bookkeeping entails accurately recording all financial transactions of a business, such as receipts, payments, purchases, and sales.

Accounting is the interpretation of financial data to provide guidance on the current and future performance of the business. With accurate bookkeeping, financial analysis is possible.

Here are some reasons why it’s important for small businesses to keep accurate books.

1) Saving Time

Prioritizing accurate bookkeeping is essential for any business to save time in the long run.

Allocating time to this task regularly can help avoid costly mistakes and the need to scramble when needing up-to-date financials for transactions.

If bookkeeping is neglected and rushed, there is a higher chance of errors which could lead to bigger problems in the future.

2) Improved Cash Flow

Accurate bookkeeping practices can help improve your business’s cash flow.

By keeping your income and expenses organized and up-to-date, you can easily monitor how much money is coming in and out of your business.

This will help you quickly identify any potential cash flow issues and take the necessary steps to address them.

The National Federation of Independent Business reports that cash flow problems are one of the leading causes of business failure, so accurate bookkeeping is essential to the success of any business.

3) Stays Away From Late Fees And Penalties

Accurate bookkeeping is a key tool for avoiding costly late fees and penalties. By tracking payables and taking advantage of early payment discounts, you can keep your payments up to date and save money.

Moreover, having a proper bookkeeping system in place will help you ensure your payroll remittances are paid on time and avoid the financial consequences of late payments.

4) Reduced Administrative Costs

Accurate bookkeeping is one of the best ways to reduce administrative costs. Keeping accurate records of income and expenses can help streamline the accounting process and minimize errors.

Additionally, regularly reviewing financial statements and accounts receivable and accounts payable can provide insight into areas where costs can be reduced.

5) Accurate Tax Filing

Accurate bookkeeping services for small business success is essential in order to ensure timely and accurate tax filing. Good bookkeeping practices can help to identify all available deductions and tax credits while reducing the chances of costly penalties and audits.

By keeping meticulous records, business owners can maximize the potential deductions and credits available to them and ensure that their tax returns are filed correctly and efficiently.

6) Having access to funding

Having accurate bookkeeping is essential for businesses seeking to obtain financing. Lenders will carefully review your financials and require timely, up-to-date information in order to approve a loan.

Having your books in order will provide the necessary insight into your business’s finances and cash flow history, which is necessary to determine if you need financing and which type of loan is the best fit.

Keeping your financial records up-to-date and organized will also make the loan application process much smoother.

Common Bookkeeping Mistakes to Avoid

Bookkeeping is essential for business success, as it allows you to track your profits and understand your financial situation.

Without proper bookkeeping, you won’t be able to accurately identify your company’s profitability, set goals, or accurately assess your business’s performance.

To ensure that you’re making the most of your bookkeeping efforts and avoiding costly mistakes, here are some tips to help you improve your bookkeeping habits:

1. Poor record-keeping

Poor record-keeping is an all too common mistake made in bookkeeping.

It is important to take the time to set up a system of record-keeping that is accurate and organized.

Poor record-keeping can lead to inaccurate financial reporting, missed tax payments, and other costly errors.

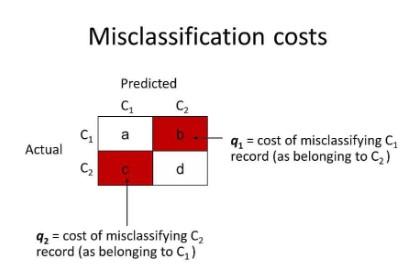

2. Misclassification of Every Expense

Accurate bookkeeping is essential for a successful business. Mistakes can be made without proper knowledge and experience in bookkeeping, which can lead to serious consequences.

It is important to ensure that all income and expenses are correctly tracked and categorized in order to accurately understand profitability and ensure proper bookkeeping.

3. Not Balancing Bank Accounts Correctly

It is important to maintain separate bank accounts for business and personal use.

Many sole proprietorship firms are guilty of having only one bank account, as they believe that the money they earn is their own profit. However, this can create confusion when it comes to auditing.

To ensure that expenses and earnings are accurately tracked, one should reconcile their business account statements on a monthly basis.

4. Ineffective Internal Communications

Having effective communication between your employees and bookkeepers is an essential component of a successful

Any lack of communication can lead to errors in the firm’s financial statements, which can then have an effect on the entire auditing process.

All personnel involved should have an understanding of both internal and external expenses and financial transactions, no matter how small.

To ensure your organization operates at its highest potential, it is important to maintain a strong relationship between your staff and bookkeepers.

5. Poor Cash Management

Having a small amount of cash and not keeping track of it is one of the most common bookkeeping mistakes made by new business and small business owners.

To avoid this poor cash management, it is important to keep a petty cash lockbox and track all receipts. This will make it much easier to record and manage reimbursements.

Best Practices for Accurate Bookkeeping

Small businesses need efficient bookkeeping to thrive in this competitive marketplace.

With the help of an experienced bookkeeper, businesses can avoid payment issues, use their financial reserves wisely, and grow their company. Here are essential bookkeeping best practices for small businesses to follow:

1. Utilize Bookkeeping Software

Best practices for accurate bookkeeping include utilizing bookkeeping software to keep track of financial records, such as income and expenses, and to create financial reports.

Additionally, it is important to stay organized and up to date with bookkeeping records, reconcile accounts regularly, and make sure to keep accurate records of all transactions.

Lastly, it is important to consult a professional accountant or bookkeeper if you need help understanding the bookkeeping process or managing your financial records.

2. Use a Professional Bookkeeper

The biggest mistake small businesses make is hiring incompetent accountants.

It’s essential to find the right people to manage your accounting department as they can help you save money on taxes and make the process easier.

Investing in the best technology won’t make a difference if your bookkeepers don’t know how to use it effectively.

Although these professionals may ask for a higher salary, their expertise is invaluable and worth the investment.

3. Regularly Review Accounts

It is worth the effort to monitor your bookkeeping practices regularly. Before any invoices are approved, ensure they are reviewed and verified by the accounting department.

Additionally, it is important to thoroughly check each invoice before giving approval. If you do not have a reliable bookkeeping team, consider outsourcing your accounting and bookkeeping work to an experienced firm that implements control measures.

Establishing a solid and consistent review and approval process across the firm is essential to ensure that rules are followed by all

Conclusion

In conclusion, accurate bookkeeping services for small business success are very important.

Without accurate bookkeeping, small business owners may find themselves unable to properly manage their finances, leading to costly mistakes and potential financial ruin.

Accurate bookkeeping services can provide owners with a better understanding of their finances, allowing them to make smarter decisions and increase their chances of success.