Cash flow is vital for the financial health of any business, reflecting the movement of money in and out of the organization. While positive cash flow is ideal, negative cash flow can be concerning. In this guide, we explore the concept of negative cash flow. Its impact on businesses, and the underlying causes, such as low sales, high expenses, and poor financial management. We help handle negative cash flow with sensible financial management tactics. This guide helps business owners, startup founders, and investors. To manage this crucial financial component. With our accounting services for small businesses and a trusted bookkeeper near you, you can confidently navigate the challenges of cash flow management. Let’s explore the world of negative cash flow and discover how to manage it successfully.

What’s a Negative Cash Flow?

As a small commercial enterprise owner, you want to ensure that your earnings are sufficient to cowl your costs. When you examine the traits in your spending and income, you are looking at the cash drift of your business. Sometimes, you make less money than you spend. How does inverted or negative cash flow work?

Cash Flow: How It Works

Before understanding negative cash flow, you need to know what cash flow is. Cash flow is a way to track how much money comes in and goes out of your business over a specific period. It would be best if you could match income changes with expenses for a good cash flow.

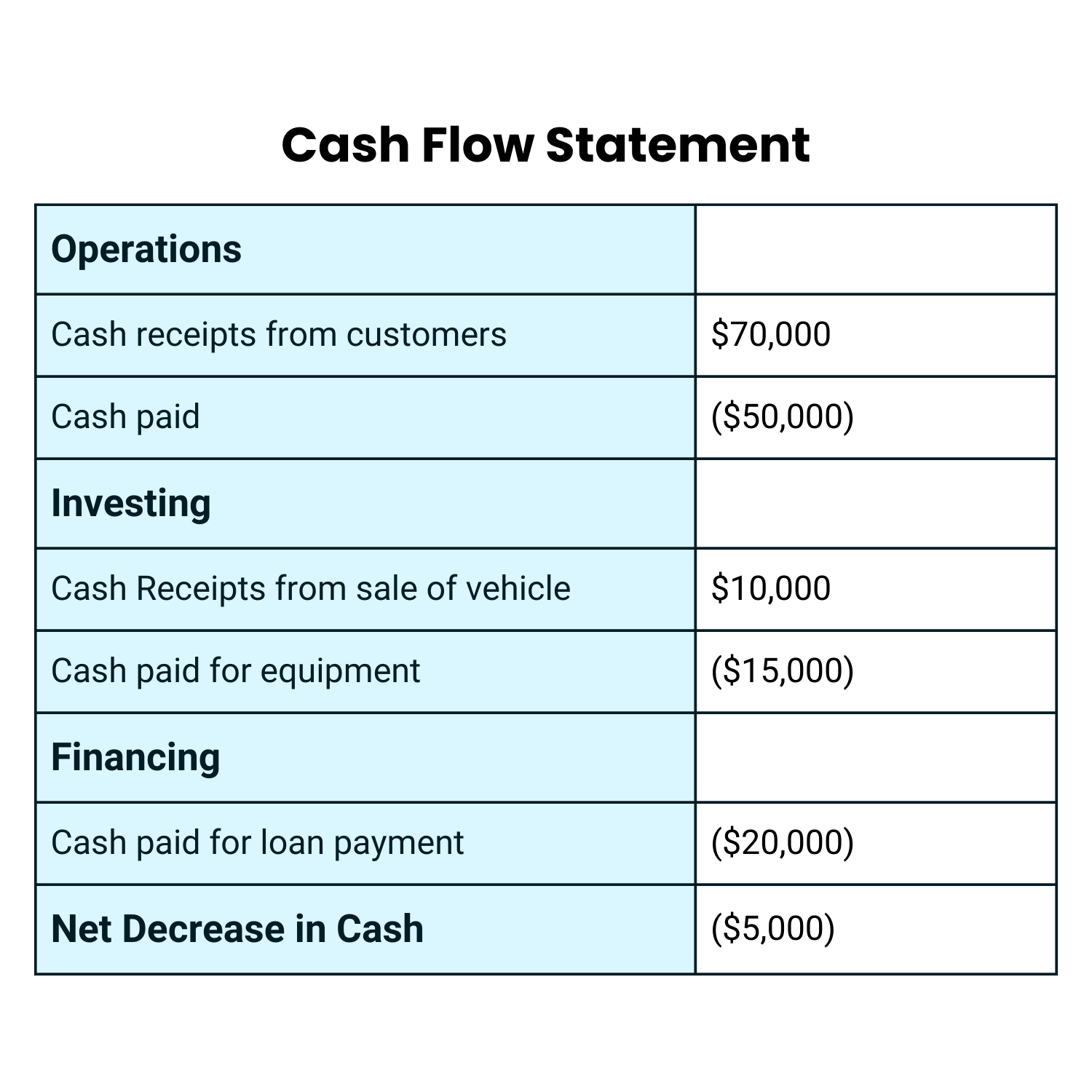

On the cash flow sheet, you write down how much money your business brings in. On the statement of cash flows, cash is put into three groups:

- Operations are things that make money.

- Financing demonstrates your company’s obligations, equity, liabilities, and debt payments.

- Investing is the act of selling and buying things.

In an SBA article, Marco Carbajo, an expert on business credit. And founder of the Business Credit Insiders Circle talked about how important it is to handle cash flow:

View this post on Instagram

A post shared by Jayanthi Ganapathy- Bookkeeper & Tax strategist (@jayanthi_ganapathy)

“Cash flow is important for every business because it helps pay for the day-to-day costs of running a business. Cash flow is the lifeblood of a business. It keeps the lights on and the doors open. Companies of all kinds and shapes often have to slow business growth because they don’t have the cash flow they need to grow”.

If you keep track of your cash flow, you might notice that sometimes you spend more money than you bring in. At other times, you might get more money than you spend. Small business bookkeeping plays a crucial role in monitoring. And manage your cash flow effectively. Keep proper financial records and track income and expenses.

To estimate your business’s coins flow effectively. Your business may have positive or negative cash flow. Depending on how much money comes in and how much goes out.

How Does Negative Cash Flow Work?

Negative cash flow occurs when a business spends more money than it generates in revenue. It indicates that expenses exceed sales, leading to a shortfall. To bridge this gap, businesses often rely on additional funding from investments or loans.

For instance, if a business earned $5,000 in April but incurred $10,000 in expenses, its cash flow would be negative.

It’s common for new businesses to experience negative cash flow initially. However, sustaining a business becomes challenging if cash flow consistently remains negative. Insufficient revenue to cover expenses eventually depletes funds over time.

To effectively manage cash flow and address negative scenarios. Employing the services of bookkeeping service can be invaluable. These experts assist firms monitor their income, expenses, and financial health. Businesses can learn cost management, revenue optimization, and financial decision-making from them.

In this guide, we’ll explore the dynamics of cash flow and offer practical strategies to overcome it. With the support of full-service bookkeeping, you can proactively monitor and control. Your cash flow ensures the long-term sustainability of your business.

What Does a Small Business’s Negative Cash Flow Mean?

When your business has a negative cash flow, it may be losing money. Sometimes, a negative cash flow is caused by bad timing when money comes in and goes out.

You can have a net profit even if your cash flow is bad. For instance, one of your bills might be due before a customer pays you. When this happens, you don’t have enough money to pay your bills.

When you have a negative cash flow, you can’t put money back into your business. Instead, your goal is to keep your business from going under. When you have a negative cash flow, it’s hard to grow your business.

Example Of a Negative Cash Flow

The annual cash flow of one business is shown in the cash flow chart below. The document shows that the business has a cash flow deficit. The business lost money because it spent more than it made.

Managing Cash Flow Problems

Long-term negative cash flow is bad for the finances of your business. You can improve your cash flow in several ways. Try out these tips for managing cash flow in a small business.

#1. Check the Source

First, figure out why you are losing money. Find out if your business is making a loss or if your cash and expenses do not add up.

Cash Flow Loss From Operations

To find out why your cash flow is negative, take your payables away from your receipts.

Receivables – Payables

If the difference between your receivables and payables is less than zero, you have negative cash flow from activities. Your income is less than the amount of money you need to pay for your bills. Either you don’t sell enough or you spend too much.

If receivables minus payables is a positive number, you are losing money because your income is less than your costs. You need to change when your costs and income come in.

Negative Cash Flow From the Assets

On the other hand, companies that spend on fixed assets like land or equipment may be more likely to have a negative cash flow from assets. You can find your cash flow from assets by taking your operating cash flow. And subtracting capital costs and additions to net working capital.

Operating Cash Flow – Capital Spending – Net Working Capital;

If you have a cash flow from assets, it means that you are spending more money on the long-term growth of your business than you are making.

2. Negotiate Payment Conditions

You tell your customers when they need to pay you so they know when to do it. You also agree to the invoice payment terms of your providers so you know when to pay them. Either of these types of payment terms can be changed to improve cash flow.

Reduce the number of days customers have to pay you when setting payment terms. For example, if you give people 45 days to pay you now, cut that to 30 days. You should get paid for your invoices more quickly.

Talk to your suppliers about how you will pay them. Some types of vendors might be ready to give you more time to pay their bills. Or, ask the vendor if you can set up a plan to pay off the sum in smaller amounts.

3. Talk To Lenders

You might need to invest or borrow money to make up for low sales. You can ask your bank for a loan for your small business. The Small Business Administration also backs loans for small businesses that meet the requirements for an SBA loan. Getting a loan from a bank should be easier if you have the SBA’s stamp of approval.

You could get a credit card for your business to pay for costs. Before you sign the deal, check the interest rates. Pay back the loan quickly to avoid getting into more debt.

4. Reduce Operational Costs

Check your current running costs to see if any of them can be cut or gotten rid of. Make sure you aren’t paying too much for the goods and services your business needs. Check out what other sellers have to offer to see if you can get a better deal.

5. Increase Sales

Cash flow will also be better if there are more sales. You can lower the price of old items you want to sell.

Hold sales and other events that make people want to buy more. You can also grow the way your business works. For example, you could give more things or let people buy from you online.

Conclusion

In conclusion, businesses must comprehend negative cash flow. And execute appropriate management methods to stay afloat. Businesses can overcome negative cash flow by forecasting cash flow and strengthening accounts receivable. Managing negative cash flow and achieving long-term financial stability. And growth demands proactive financial planning and data-driven decision-making. Negative cash flow is transient and may be overcome with strategic tactics and a resilient mindset.

Explore our website for more information on managing cash flow, optimizing financial processes, and gaining valuable insights for your business’s financial success. Visit https://finaccurate.com/ today and empower your financial management practices.

Frequently Asked Questions (FAQs)

Ques. How to improve the accounts payable process in a business?

Ans: Streamlining operations, using technology, and improving vendor communication help enhance accounts payable. This reduces manual errors, speeds up invoice processing, and boosts efficiency.

Ques How to improve accounts payable effectively?

Ans: To improve accounts payable efficiency:

- Streamline invoice processing with electronic invoicing and automation.

- Implement a centralized payment system for better tracking and control.

- Negotiate favorable terms of payment with suppliers.

- Use technology for accurate invoice matching and prevention of errors.

- Establish clear approval workflows to avoid delays.

- Regularly reconcile accounts payable for accurate records.

- Leverage vendor management techniques to reduce costs.

- Optimize cash flow forecasting for better payment management.

- Encourage early payment from customers with incentives.

- Monitor and analyze accounts payable metrics for improvement.

- These tactics boost corporate productivity, lower expenses, and improve cash flow.

Ques: What are some of the best-outsourced accounting services available?

Ans: Here are a few top outsourced accounting services:

- Xero

- QuickBooks Online

- Bench Accounting

- Bookkeeper.com

- Pilot

- Bench

- inDinero

- BDO

- Deloitte

- PWC

Watch Now –